Maximizing Efficiency: How the Right Accounting System Can Streamline Your Business Operations

Table of Contents

Definition of an Accounting System

A system used by a business to arrange its financial data is called an accounting system. It can be done manually or with a computer. Maintaining track of your spending, income, and other activities is the major reason you should be using an accounting system. Basically, monitor every information that has an impact on a company’s finances.

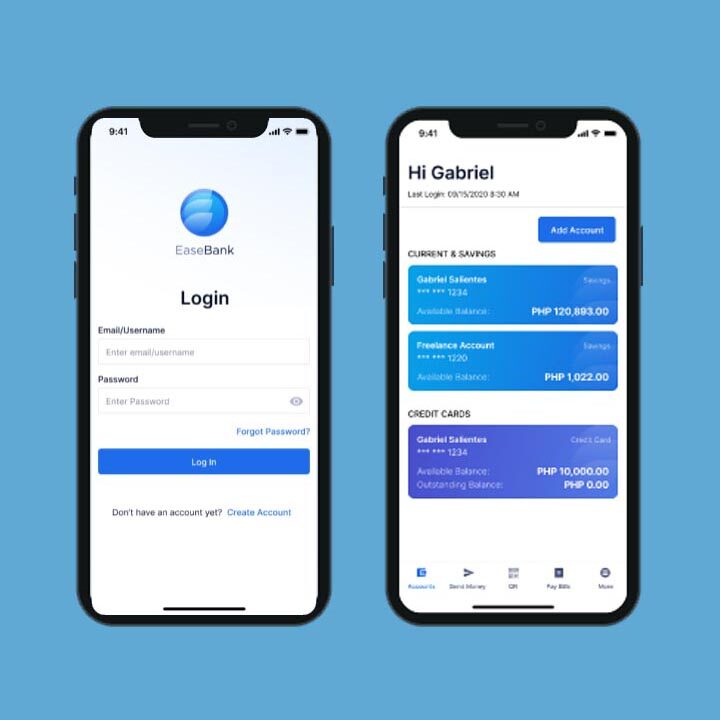

Accounting systems assist companies in monitoring and controlling their financial activities. Sales, purchases, assets, and liabilities are all included in it. A business accounting system comes in very handy for producing reports. As a company owner, you are undoubtedly already aware of how important accurate data reports are to the decision-making process. All of the data was collected manually in the past. Fortunately, we are fortunate to live in a computerised age. And that makes it simple for us to store the financial records. Now, all it takes to enter, modify, and interpret data is to log onto your accounting system on a computer or mobile device. In the past, balancing the ledgers required a tonne of hand calculations.

Accounting System Types

Accounting for Managers

Managers can use this accounting style to get the data they need for planning and operations control. Lean and cost accounting fall under managerial. Cost accounting keeps track of the expenses a company incurs during different operations and transactions. Lean accounting is used to analyse processes to find ways to cut costs and stop wasting resources while adding value.

Accounting for Inventory

These offer a way to monitor and schedule inventory levels and associated tasks. Among the widely used inventory accounting systems are RFID and barcode tracking.

Accounting Particular to a Sector

This is a system designed with a particular industry in mind. A legal accounting system and one for a sales company, for instance, are very different. Each has particular needs that are appropriate for various businesses.

Accounting for Non-Profits

There are certain standards for this kind of accounting as well. It mostly entails making certain that funds are allocated appropriately. It should be possible for the system to generate expense reports.

In today’s fast-paced and competitive business landscape, maximizing efficiency isn’t just a goal; it’s a necessity. As businesses strive to optimize their operations, the role of an effective accounting system has become increasingly crucial. An accounting system isn’t merely a tool for managing finances; it serves as the backbone of a company’s operational structure, playing a pivotal role in streamlining processes and fostering growth. This article delves into the significance of choosing the right accounting system and how it can revolutionize and optimize business operations.

Understanding the Core of Efficient Business Operations

Efficiency in business operations revolves around the optimization of resources, time, and processes. An effective accounting system lies at the heart of this optimization, as it provides the necessary framework to manage financial transactions, monitor cash flow, track expenses, and generate vital reports for decision-making. By automating and organizing these fundamental financial tasks, a robust accounting system becomes the cornerstone of operational efficiency.

The Impact of the Right Accounting System

Choosing the appropriate accounting system tailored to your business’s needs can significantly impact operational efficiency in several ways:

1. Streamlined Financial Processes: An advanced accounting system automates various financial processes, reducing the need for manual intervention. It simplifies tasks such as invoicing, bill payments, and payroll management, allowing staff to focus on core business activities rather than administrative chores.

2. Real-Time Insights: Modern accounting systems offer real-time data and analytics, providing up-to-date financial information crucial for making informed decisions. These insights empower businesses to react promptly to market changes, identify trends, and adapt strategies accordingly.

3. Enhanced Accuracy and Compliance: Automation reduces the chances of human error in financial calculations and ensures compliance with regulatory standards. Accurate financial data minimizes the risk of errors in tax filings, audits, and financial statements, avoiding potential penalties or legal issues.

4. Improved Cash Flow Management: An efficient accounting system enables better cash flow management by tracking income and expenses, predicting future cash needs, and identifying areas where costs can be minimized or revenue increased.

5. Facilitates Scalability: As businesses grow, their financial needs evolve. A scalable accounting system can accommodate increased transactions, additional users, and expanded functionalities without causing disruptions to operations.

Key Features to Look For

When considering an accounting system for your business, several key features can significantly contribute to optimizing operations:

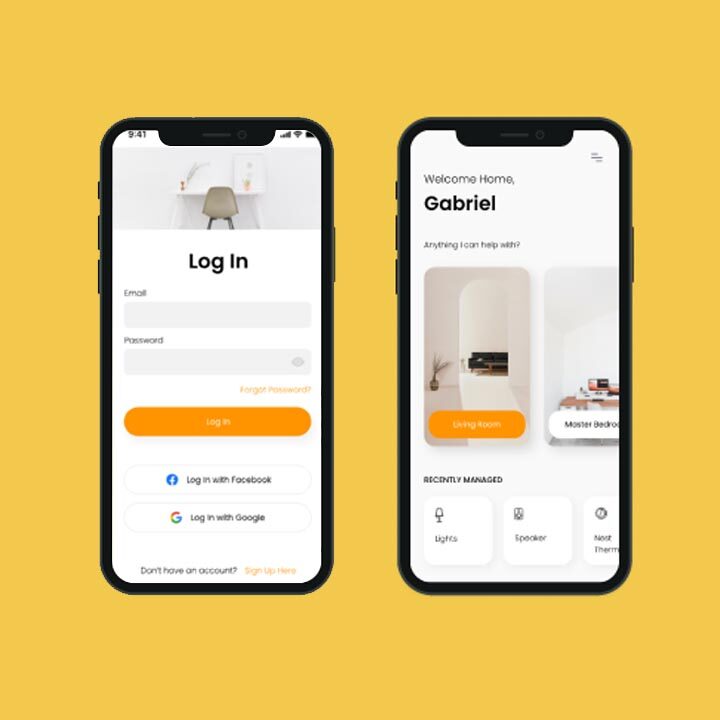

1. Cloud-Based Accessibility: A cloud-based accounting system allows secure access to financial data from anywhere, facilitating collaboration among team members working remotely or across different locations.

2. Integration Capabilities: Compatibility with other business software, such as customer relationship management (CRM) or enterprise resource planning (ERP) systems, enables seamless data exchange and reduces duplication of efforts.

3. Scalability and Flexibility: The ability to scale the system according to your business’s growth and adapt it to changing needs ensures long-term viability and efficiency.

4. Automation of Routine Tasks: Features like automatic invoicing, recurring billing, and bank reconciliation streamline processes, saving time and reducing manual errors.

5. Robust Security Measures: A secure accounting system with encryption, multi-factor authentication, and regular data backups is essential to protect sensitive financial information.

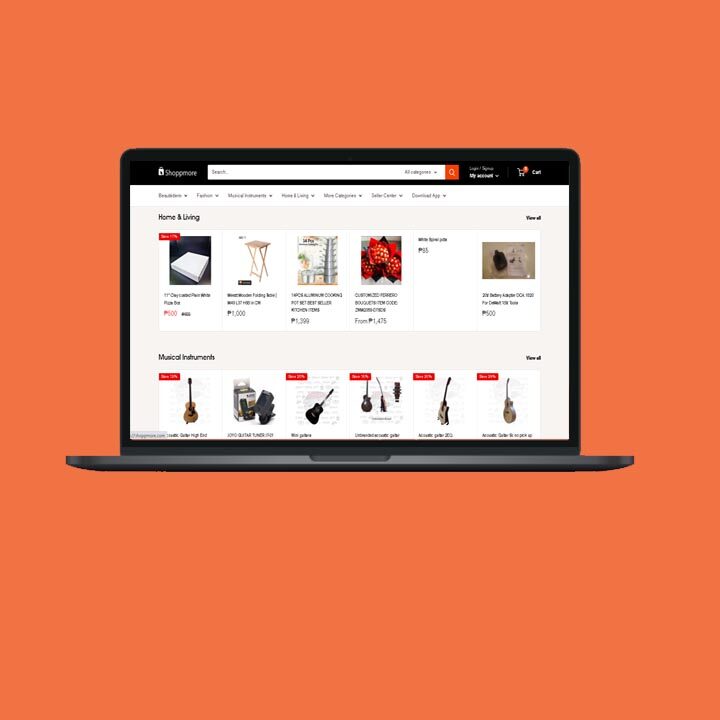

Top Accounting Softwares Sorted

The ideal accounting software for your business will rely on your particular requirements and the sector you operate in. Here are our top suggestions for the three most popular categories of accounting software to help you get started on your quest.

QuickBooks Online Is the Best General Accounting Software

It’s difficult to argue against QuickBooks’ industry heritage as it’s an established standard that has grown to integrate cloud technology. Small enterprises in various sectors would benefit most from its straightforward interfaces, readable data visualisations, and opportunities for automating repetitive tasks.

Best-Rated Modules

Asset Management, Banking Management, Financial Statements, Inventory Management, Tax Management

Benefits

Simplify Procedures: Financial data may be input, edited, delivered, and transferred with ease.

Set Permissions: To safeguard sensitive data, use role-based access.

Minimise Errors: By using automation technologies to get rid of typos and other human errors, you may increase workflow productivity.

Work Together Efficiently: Modified versions of files are automatically updated for all users with access in the cloud after modifications are made.

Features

Income and Expense Tracking: Connect transactional data straight to spending.

Estimates: Turn estimates into invoices and edit them to meet organisational needs.

Reporting: Convert visualisations into data that may be used for action, and prepare any required financial reports.

Transaction management: Maintain a single location for records of all expenses.

Inventory tracking: Keep an eye on goods and prices, pinpoint best-selling items, and predict buying patterns.

Constraint

For small firms, software can be very expensive.

Acumatica is an ERP Software

Acumatica is perfect for small and medium-sized businesses because it has an extremely configurable UI and strong app interconnectivity. It offers centralised transactions, strong automation features, and real-time monitoring to provide complete visibility into every facet of a business’s finances.

Best-Rated Modules

Banking Management, Financial Statements, Payroll Management,

Project Accounting and Tax Management

Benefits

Boost productivity by automating accounting and data entry duties so you can concentrate on strategic planning.

Centralise Data: Customise dashboards and keep an eye on everything from one place while monitoring in real time.

Support Multiple Currencies: Go global with business and stay compliant internationally.

Handle Multiple Sites: Based on the organisational structure of your business, divide or centralise accounting.

Simplify Compliance: Pay taxes without requiring additional human labour.

Features

General Ledger: Organise by accounts and subaccounts, make statements, and keep track of transactions.

Accounts Payable: Handle requests and automatically apply advance payments.

Accounts Receivable: Prepare invoices, send them, and manage reimbursements.

Cash Management: Record transactions and update balances.

Manage your currency by calculating realised gains and losses and adjusting for unrealized gains.

Constraints

The response time of third-party support isn’t responsive

It takes a long time to implement.

Microsoft Dynamics 365 Finance is a Payroll Management Software.

Dynamics 365, an effective solution that is simple to set up for use in any location, is included with the accounting platform of Dynamics 365. Your financial needs are met by the rest of Dynamics 365’s accounting suite, which manages everything from analytics to automation.

Best-Rated Modules

Budget Management, Financial Statements, Payroll Management, Tax Management

Benefits

Improve Your Strategy: Make use of AI tools to compute payroll and taxes automatically, and AI-driven data to predict financial patterns.

Minimise Risks: Quickly adapt financials to bonuses, raises, and changing tax rates.

Budget Wisely: Maintain accurate financial records to keep tabs on your finances.

Features

Reporting: See the whole picture of the company’s financial situation.

Machine Learning: Use predictive analytics and a hands-off approach to drive growth.

Role-based Workspaces: Protect sensitive information and, if necessary, limit access.

Compliances: Adhere to 37 countries’ compliance requirements.

Financial Planning: Automate financial processing and budget control.

Constraints

Limited amount of storage.

Sometimes there are lags when loading data.

Conclusion

In an era where efficiency is the linchpin of success, the right accounting system can be a game-changer for businesses. It not only manages finances but also serves as a catalyst for optimizing operations, improving decision-making, and fostering growth. Investing in a robust accounting system tailored to your business needs is a strategic move that can unlock new opportunities and propel your business toward sustained success in today’s competitive landscape.

Submit the form below if you need help for any Custom Software Development or ERP System

Email us: info@digiglobalsolutions.com

Call Us: +63 917 109 8211